It costs a lot to live these days. Overall inflation, jacked up food and gas prices, and unreasonable housing costs are hurting just about everyone. If you also fall into that camp, we’ve got some easy ways to examine your expenses and free up some funds!

Bust Open the Books

The first thing you need to do to get your spending under control is to break open the books and take a long, hard look at how you’re spending your money. Where does it all go? Be brutally honest with yourself and figure out what’s eating up your spending money.

Fixed Spending

Some things are fixed: your rent or mortgage, your car payment, your car insurance. You need a place to stay, so consider getting a roommate to help with the rent or mortgage. If you don’t need a car, consider selling it and saving money by using a bike or public transportation.

Variable Spending

Other spending is variable. Things like paying for your groceries, streaming services, phone bill, and so forth is all spending that’s pretty much not up for discussion. What you can do, though, is look for deals: coupons for groceries, streaming service discount bundles, and phone service from a smaller, cheaper competitor.

Discretionary Spending

Some spending is fully discretionary. Going out to a fancy restaurant to eat, buying luxury items, going to the movies. Don’t deny yourself the simple pleasures in life, but consider cutting back on these indulgences a bit to keep your finances under better control.

Make a Budget

Give every dollar a job before it ever hits your bank account. This will help you keep a good handle on what you should be spending and when. It will keep you from spending more than you earn, thus getting yourself into deeper financial trouble.

Electricity

You can cut your power bill down by using less electricity. Set your thermostat closer to the outside temperature, take shorter showers, and only run the dishwasher or washing machine when you have a full load. You’ll be surprised at how much these simple changes will save you.

Sustainability

You can also save money by going green. High-efficiency light bulbs last longer, public transportation is cheaper than a personal vehicle, and growing your own food keeps your grocery bills lower. Every little bit helps the planet and also your wallet!

Subscriptions

Get a handle on those subscriptions. Are you subscribed to streaming services you never watch? Cut them from your monthly budget. Don’t hang on to them thinking “oh what if I want to watch it someday?” Just stop spending money on something you won’t ever use.

Insurance Premiums

Drive carefully and stay healthy to get those insurance premiums down. Not only will safe driving and healthy habits help you live longer, they’ll help you enjoy more of your own money while you’re here! People who make risky decisions like smoking or driving recklessly pay far more for health and car insurance, respectively.

Housing Tips

If you rent, offer your landlord to fix your own issues for a break on the rent. If you own, look into getting your private mortgage insurance canceled if you’ve got more than 20% equity in your home. Either of these options will reduce your monthly housing bills and get you ahead of the curve.

Debt Consolidation

Do you have a lot of outstanding debts, like loans and credit cards? Don’t panic. Get a debt consolidation loan to pay them all off. This rolls them all into one loan and can usually get their interest rates much lower.

Debt Management Plans

You can also talk to a nonprofit organization that offers debt management plans. Many of these organizations have inroads with card issuers and can see about getting your payments lowered, your interest rates slashed, and getting your debt paid off faster. Really, the card company just wants something, they’re not opposed to working with you.

Cooking Meals

Yes, eating at restaurants is nice. However, you need to cook most of your meals at home if you want to keep from spending hundreds of dollars per week on food. Make a plan and stick to it. Cook meals for the week, meal prep to keep costs down, and freeze larger meals to heat up throughout the week.

Read More: 10 Things to Know Before You Refinance Your Mortgage

Shopping List

When you go to the store, make sure you have a shopping list. You’ve got meals planned for the week, so just buy the ingredients for those recipes. Don’t go off your list and buy all the snack foods that catch your eye: these are as bad for your health as they are for your wallet.

Read More: 20 Tips for Early Retirement

Cash Diet

Forget the credit cards and loans. Just use cash to buy anything you need. This will forcibly prevent you from spending on credit and will show you exactly how your money moves around. It’s much harder to authorize gigantic payments when you physically see the large sums of cash leaving your wallet or purse.

Credit Cards

When it comes to credit cards, it’s important not to view them as the enemy. Credit cards can help you afford things you might not otherwise be able to cover in a given pay period. And, as long as you’re paying them back in time, you won’t incur any interest, making them basically a free payday extension.

Credit Card Rewards

Also keep in mind that your credit cards might have rewards points or cash back. Smart use of your rewards points can help you save money, rather than spending it. Make sure you don’t spend for the sake of chasing points, just let them occur naturally with your normal spending.

Don’t Let Sales Fool You

A lot of people fall for sales tactics because they’re often quite advanced. Don’t let these tactics fool you! If you don’t need something, just don’t buy it. It doesn’t matter if it’s fifty percent off. You’re not “saving” money by buying it, you’re just buying it for a lower price than normal.

The FOMO Trap

These sales work by getting you to fear the concept of missing out on a deal. What if you don’t buy this widget now while it’s $10 and next week it’s $20? Well, here’s the thing: you don’t even need a widget. Ignore it! If you buy it for $10 now, you haven’t saved $10, you’ve spent $10 on something you weren’t going to get.

Sales That Come Naturally

If something you’re already planning to buy happens to go on sale, then it’s worth pivoting your spending to pick it up at a discount, of course. Just be smart about this! Don’t let the sales encourage you to buy things you don’t need. Buy your normal things and enjoy the savings if they pop up!

Sometimes Spending More Up Front is Good

There’s another side to this theory, too, though. Some items are better to splurge on in the short term so you save more on them in the long term. For example, say you need a new pair of shoes. You could spend $30 on some inexpensive ones, but they’ll probably wear out in about three months, right?

The Expensive Ones are Worth It, Actually

Well, you could instead spend $200 on boots that will last you five years. With some quick math, buying twenty of those $30 shoes in the same time period will run you $600. Why not save $400 in the long run by buying the $200 up-front? Of course, this only applies to necessities, like shoes, that you need to buy periodically and where price is a direct factor of quality.

Buy Secondhand

You could also make an end-run around this principle by buying secondhand items, like gently-used clothing and shoes. You can often find great deals on excellent clothes that people simply donate to thrift stores. These will often last you longer than fast-fashion stuff you’d buy in a department store and will cost you a fraction of the price.

Secondhand Cars, Too

Be honest with yourself: do you really need a new car? Probably not, right? Unless you’re a businessperson with a really aesthetic-based sales job, your car is just a way to get around. Save yourself some money and buy an older car that’s easier to afford and make payments on. It’ll still get you around town!

Stop Leasing

On that same topic, you should also probably stop leasing cars. Yes, it’s nice to drive around in top-of-the-line, brand-new cars. But you know what’s better? Owning your car outright when you’ve finished making payments on it. Cars aren’t investments, but not having a car payment is a great way to get some extra finances that you can invest into the stock market.

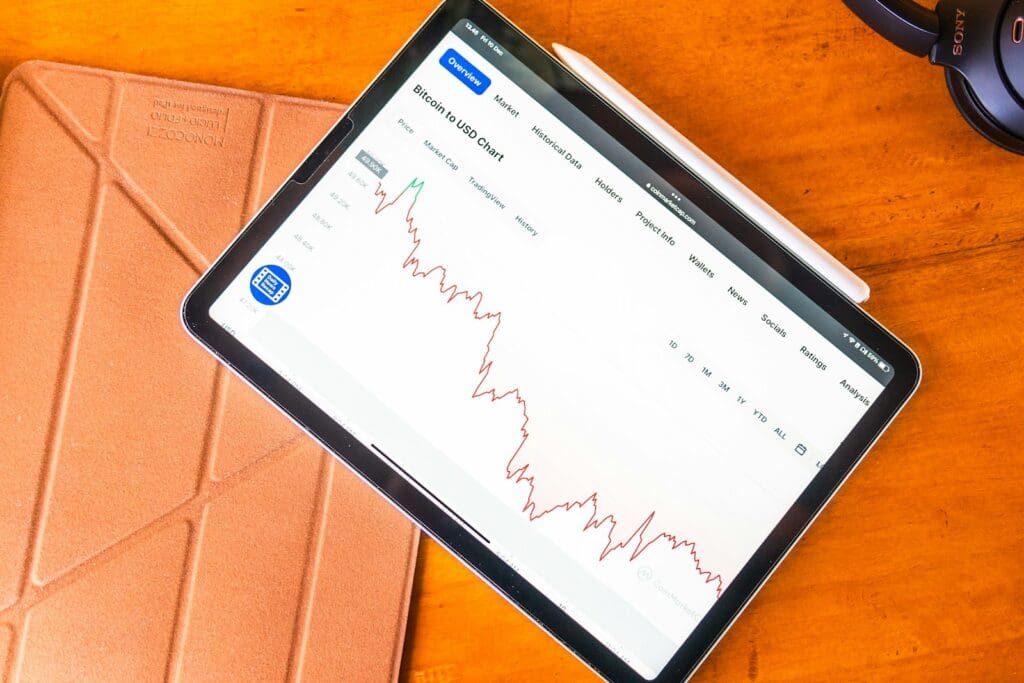

Investments

Let’s talk about those investments, too. There are a lot of ways to invest your money! The most straightforward way is to just get an investing app and start putting a bit of money back into things like ETFs or mutual funds. But how can you start investing?

Rolling Your Debts Over

Once you start getting some things paid off, you can start investing very simply. Let’s say, for instance, you pay your car off. Now you have a car and no car payment! Rather than just spending the “extra” money on whatever fun stuff, why not invest it into your preferred portfolio? You won’t notice the difference and now your money is making money for you.

Investing In Your Future

It might seem counterintuitive to invest money when you’re trying to save. After all, how are you going to make ends meet if you’re investing everything? Well, remember, it’s important to cover your needs first. But, once those are met, it’s okay to cut into your “fun” budget a bit to help secure your financial future!

Entertainment Budget

Speaking of that entertainment budget, there are a few ways you can get that spending down. Consider using free TV apps instead of keeping a bunch of streaming subscriptions. If you have cable to watch your favorite sports team, instead consider just following them digitally and downloading the app for the local radio station that covers play-by-play for their games.

Free Resources

You really don’t need to spend a dime to enjoy great books and movies, either. Your local library is completely free and has everything from awesome novels and fascinating nonfiction books to DVDs and Blu-Rays of hit movies. Some even have a video game library you can borrow from!

Read More: You Are Wasting Too Much Time Being Frugal