Debt can be stressful and overwhelming. We offer 10 strategies you can employ to reduce your debt. Eliminating debt doesn’t happen overnight. But these 10 steps will give you the tools for creating a debt-free future.

10. Budget for More Savings

Track and scrutinize your monthly spending. Consider using a budget-tracking app. Even small reductions in your spending can add up quickly. For example, if you can squeeze out $200 from your typical budget each month, you can apply that toward your debt. After 12 months, the money you saved will have paid off $2,400 of your debt balance.

9. Automate Debt Payments

Another way to ensure your debt is paid off is by using auto pay to deduct the payment from your bank account. Putting your debt payments on automatic payments ensures that you’re budgeting a certain amount toward your debt each month. It will also eliminate the chance of late payments and fees that would only increase your debt.

8. Develop a Debt Payoff Strategy

There are two strategies for paying off debt. Debt snowball: Pay off your smallest debt first while still making minimum payments on your other debt. Debt avalanche: Pay off the debt with the highest interest first while still making minimum payments on all other debt. With either strategy, use any extra money to pay extra toward the targeted debt.

7. Apply for a Balance Transfer Credit Card

If you have a good credit score, consider applying for a balance transfer credit card. Some of these offer 0% APR on the balance transfer amount for an introductory period, which can run up to 21 months. This lets you transfer your high-interest debt. The goal is to pay off the balance before the introductory period ends.

6. Apply for a Debt Consolidation Loan

Another strategy is to combine your debts into a single loan that will have lower interest than your combined debts. This is called a debt consolidation loan. You’ll generally need fair credit or better to be accepted. The idea is to get a loan with a lower APR, saving money on interest, and allowing you to pay off debt faster.

5. Apply for a Cash-Out Mortgage Refinance

If you own a home and have sufficient equity, you might consider a cash-out mortgage refinance. This allows you to turn your home’s equity into cash that you can use to pay off your debt. The idea is the lower interest rate allows you to pay off your debt faster. But remember, your home is the collateral for this loan.

4. Develop a Second Source of Income

Earning extra income can help pay off debt faster. Whether it’s a part-time job or a side hustle, all the money you earn can pay off your debt. Even if it’s less than you make hourly at your main job, it’s money you don’t have now. For example, an extra $500 monthly pays off $6,000 of debt in 12 months.

3. Seek Consumer Credit Counseling

If you struggle to pay your bills and debt, consider speaking to a consumer credit counseling service. These are often nonprofit organizations that will examine your budget and spending and help create a debt management plan to pay off debt faster. If necessary, they’ll work directly with your lenders to renegotiate your interest and fees to make debt repayment easier.

Read More: 15 Ways to Reduce Expenses

2. Renegotiate Debt

If you’ve fallen behind on debt payments, consider asking creditors to renegotiate your debt and accept a smaller payoff than the amount you owe. This is called debt settlement. You can do this yourself or hire a debt settlement company, which works for a fee, typically a percentage of the amount of settled debt. Typically, it’s a costly last resort.

Read More: Simple Advice: How to Deal With Tax Debt

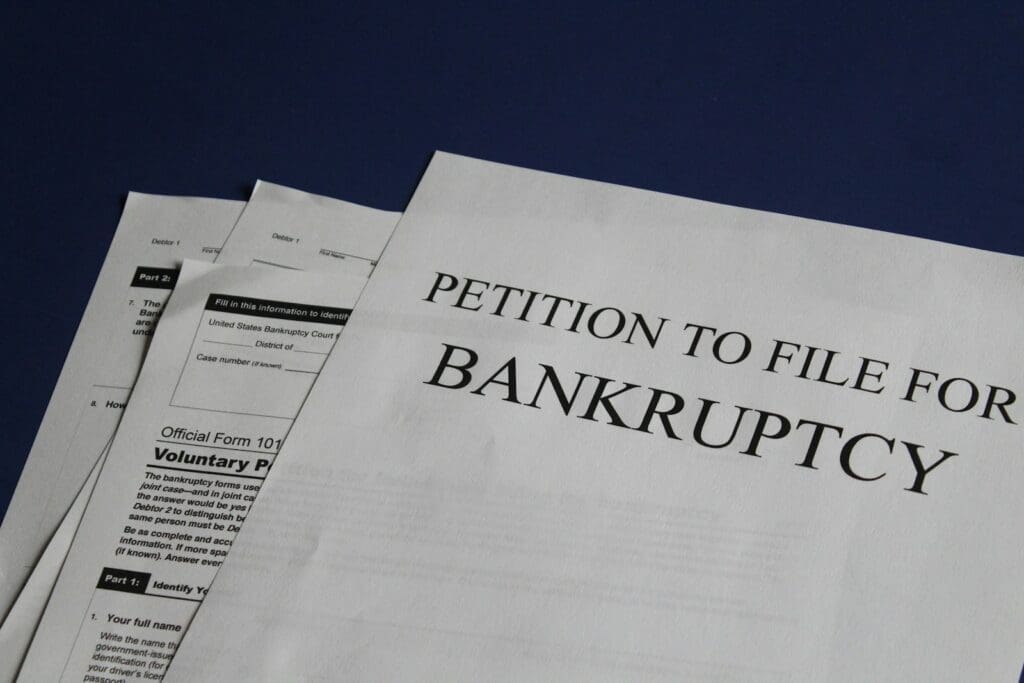

1. Declare Bankruptcy

If there is no reasonable path to paying off or resolving your debt, declaring bankruptcy may be your last option. Bankruptcy can help eliminate some debts, allowing you to rebuild your finances. It will severely damage your credit score. However, not all debts can be discharged. You might have to agree to a court-ordered repayment plan for some debts.

Read More: 10 Questions to Ask Before Taking Out a Personal Loan