Nvidia is one of the hottest names in the tech world these days thanks in no small part to their creation of the customized chips that power the next generation of AI neural network models. The company was once known for its graphics cards, primarily used in gaming PCs, but has now transitioned into being a major player in the AI industry. Their specialized chips are irreplaceable for the future of AI.

What is Nvidia?

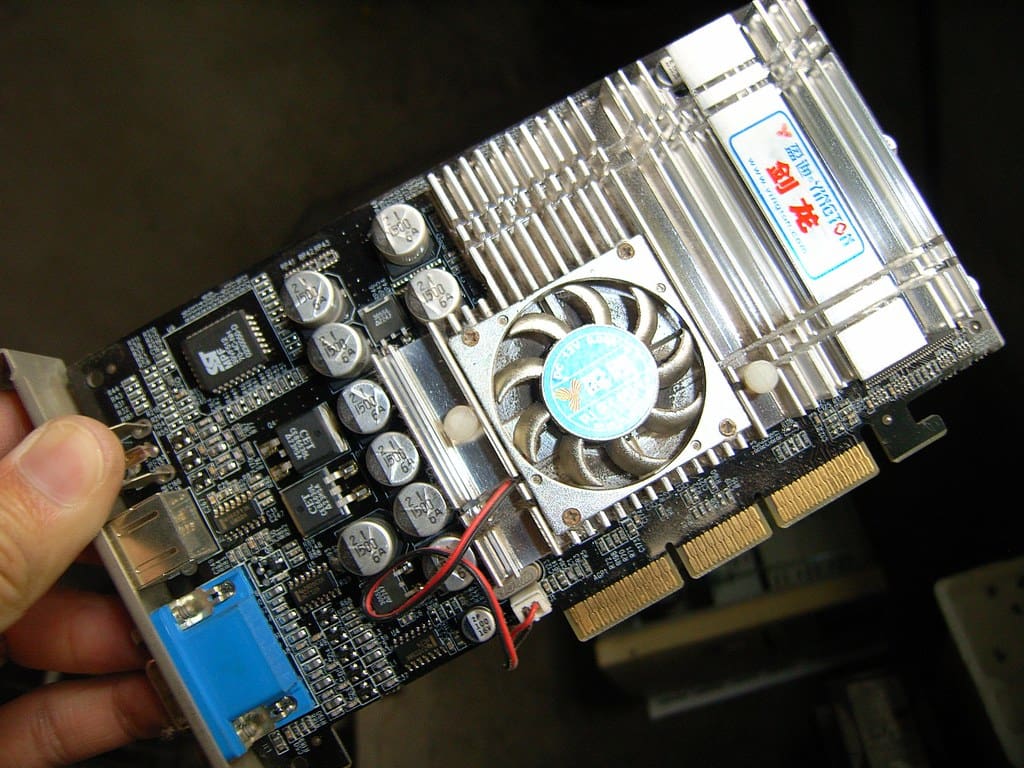

Nvidia is a tech company headquartered in Santa Clara, California that was once best-known for its graphics processing unit, or GPU, production. Computer gamers who want top-of-the-line graphics often buy Nvidia graphics cards, allowing their machines to process complicated visual effects without issue.

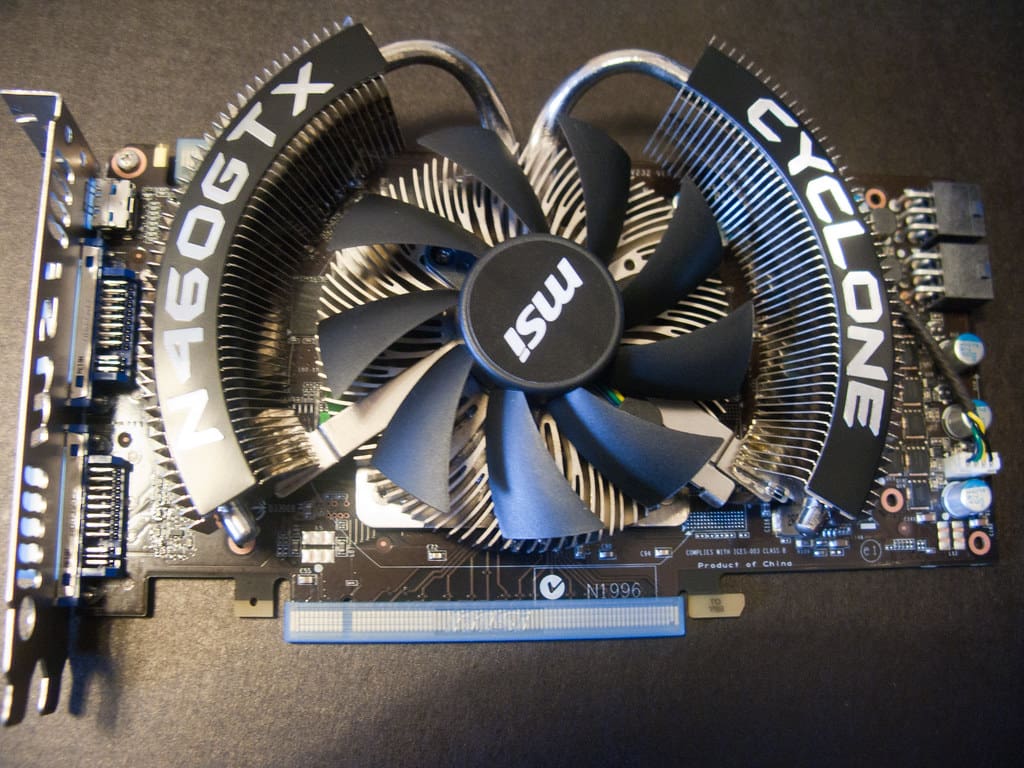

Gamer Favorite

Nvidia became a beloved company when it started making high-end graphics cards. PC gamers are a notoriously “power-user” style community, so they’re always chasing the highest numbers and looking for the most powerful computing power. Nvidia earned a reputation for making the highest-end GPUs in the mid-2010s.

Expensive Hobby

Many onlookers have noted that PC gaming is expensive. It’s dramatically pricier than console gaming, where even the most expensive systems don’t come close to the cost of an even mid-specs PC. So, why even own a gaming PC?

Versatility

PC gamers swear by the versatility offered by their gaming rigs. They can continue to upgrade them as new parts become available, utilizing a patchwork strategy that can keep them on the cutting edge without requiring them to leave their vast gaming libraries behind. This is particularly important for most PC owners because they champion user choice.

Specialized Hardware

Of course, Nvidia’s GPUs are expensive because they’re specialized. There’s not much you can do with a complex multi-thread graphics card aside from playing video games, mining for crypto, or running engineering programs like AutoCAD. This makes Nvidia uniquely positioned in the tech industry, as they create chips that few other companies have any experience with.

The Cutting Edge

Speaking of cryptocurrency, the Bitcoin boom of the early 20s was a huge boon for Nvidia. With GPUs capable of mining crypto, demand for Nvidia’s hardware went through the roof. This started a pattern of the company riding the wave of the latest tech trends and positioning itself as an opportunistic money maker.

Is That Why Their Stock Is Valued So Highly?

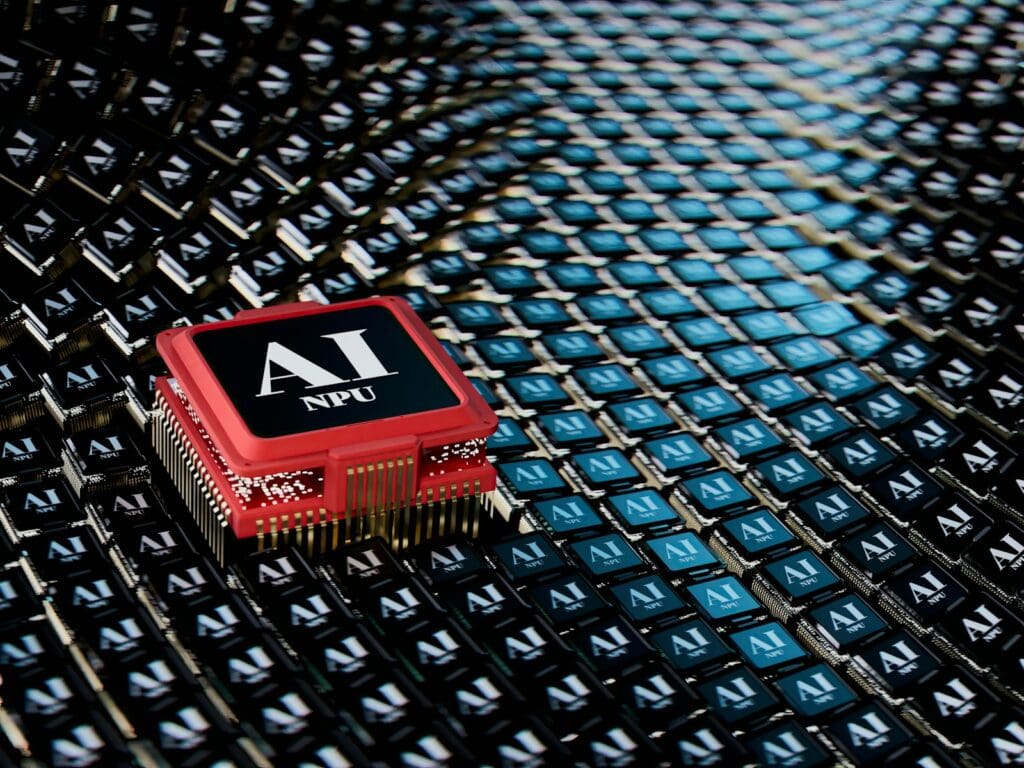

Bluntly, making GPUs doesn’t make your stock cost more than $100 per share. Nvidia hit the big time when it pivoted to selling data center chips to Google, Microsoft, and other big-name tech companies so they could make generative AI models work. That’s right, Nvidia is the AI-enabling company.

How Did This Happen?

In 2023, Nvidia became only the seventh publicly traded company in the US to be valued at over $1 trillion. For a day in June 2024, they overtook Microsoft as the most valuable publicly traded company. Put frankly, that is absurd, and it speaks to how seriously the tech world is treating the AI boom.

Second Quarter Earnings

Now that you’re caught up, here’s why people are buzzing about Nvidia right now. Wednesday, shortly after announcing its second-quarter earnings, Nvidia stock slipped, somewhat paradoxically, by about 2%. Importantly, $26.3 billion of the company’s $30 billion revenue came from its data center business.

Beat Expectations (Slightly)

Nvidia’s earnings in the second quarter of 2024 ever so slightly beat out industry expectations. Pundits were looking for Nvidia to have $28.8 billion in the second quarter. While $1.2 billion is nothing to ignore, it’s not quite the resounding win that Nvidia bulls were calling for. That could partly explain why the company’s shares slipped slightly on the news.

Expectations Target Rises

The chipmaker also announced it was raising its expectation for third-quarter revenue in light of huge demand for its current data center chips. Nvidia is now expecting to bring in $32.5 billion, while analysts were calling for around $31.9 billion. Notably, Nvidia’s expectations leave around 2% wiggle room, so that’s not far from what the industry is anticipating.

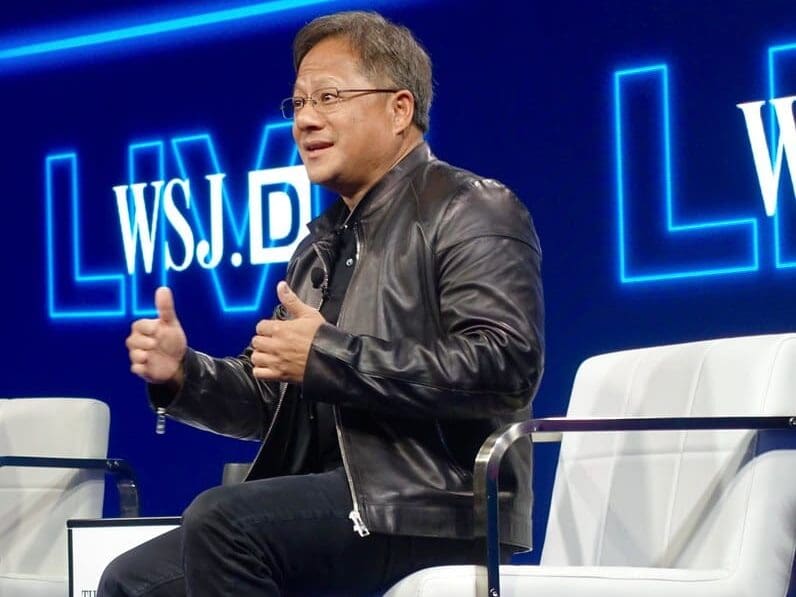

Blackwell Chip

Nvidia CEO Jensen Huang says that the tech world is hungry for the company’s forthcoming Blackwell chip. This upcoming product will reportedly be critical for next-generation AI models and is expected to drive huge revenue for the company. The company says Blackwell could easily result in “several billion dollars” in sales.

Ramping Up Production

While Blackwell won’t go into production until the fourth quarter of this year, the company says its already ramping up production of its current-generation Hopper chips. This lays out the company’s upcoming plans in clear detail, as CFO Colette Kress says investors should expect Blackwell production to continue “into fiscal 2026.”

Read More: When Will AI Start Making Money?

Gaming Division

Somewhat ironically, the company’s gaming division reported revenue of $2.8 billion. That division used to be the company’s biggest earner, and yet now it’s more of an added bonus on its data center earnings. With its new focus on AI chips, Nvidia’s past as a gaming giant is little more than a footnote to investors now.

Alibaba Partnership

More recently, Nvidia has partnered with Alibaba to help use their cloud computing platform to power a new fleet of self-driving cars. This tech is advancing despite Nvidia’s legal obligation to only send lower-end, outdated chips to Chinese companies as part of the US’s strict export laws. Alibaba’s investment in self-driving cars is a huge driver in the value of many Chinese EV brands.

Self-Driving Capabilities

Driving a car is a complicated and messy task. There are so many decision points involved in such an endeavor that it can be difficult to ever accurately program a machine that can keep up with human abilities. So, why do companies keep pursuing this goal? Because it’s the ultimate consumer luxury. The convenience of a personal vehicle with the luxury of having it drive itself? That’s ideal for many customers.

AI Assistance

So far, even the most robust self-driving programs are still in their infancy. Companies like Tesla purport to offer such technology, but their systems are in beta testing at best. Driving is difficult, and machines simply can’t respond to all the various conditions they’ll meet on the road. Look no further than the freak accidents that “Autopilot” has gotten into. Will AI assistance make this a thing of the past?

Cloud Computing

Alibaba and Nvidia plan to offload the toughest part of self-driving, the decision-making, to Alibaba’s cloud computing platform. This, when coupled with Nvidia’s unique AI chips, will supposedly reduce the computational load on the car’s systems and make it easier and smoother for these vehicles to drive themselves. Of course, safety is the number one concern.

Tour Guide and Personal Driver

The partnership will also seek to make cars into their drivers’ personal assistants. Nvidia and Alibaba speculated about the possibility of an on-board AI telling drivers about local landmarks, offering guidance on where to eat, and giving tips for safety settings in various road conditions. If it works, it sounds like the car of the future. But is AI really at that point already?

Read More: Is GameStop Meme Stock Still a Thing?

Is AI Here to Stay?

Of course, this means that Nvidia’s stock value is now directly tied to the fate of AI. Will AI prove to be profitable for the tech companies that are investing billions of dollars into it? Is general AI a real possibility, or is it just a science fiction pipe dream? For now, companies are burning a lot of money to find out.

AI Speculation

Right now, companies are banking big on AI proving useful in some practical situations. Computer technology has finally grown sophisticated enough to create algorithms capable of mimicking human speech patterns and collating large data sets to create useful outputs. These AIs could have interesting applications for the world’s biggest companies.

Big Tech Loves AI

The most important names in the tech world, including Microsoft, Google, and Facebook, are piling into the AI sphere. These big tech companies are burning billions of dollars to ramp up their AI infrastructure, and computer chips capable of performing complex tasks like large language models are critical to that plan. They’re betting that AI is the future of the tech industry.

Why Does AI Matter?

Despite their excitement, companies haven’t really proven anything about AI yet. Investors are beginning to grow a bit dubious about the technology, given its exorbitant costs and seemingly narrow present-day use cases. Still, many tech-savvy people are very excited about thinking machines that can handle any intellectual problem. But what does that mean in the real world?

Practical Applications

Companies have put a lot of money into making AI the future of everything. There are some genuinely impressive practical applications for the technology, too! It can create vast amounts of text in a short span of time, generate code for tired programmers, and even create entire images by collating existing data. Still, that doesn’t mean that they can actually replace human workers in most fields.

Finding the Money

Of course, the trick for companies betting big on AI is going to be finding the money. Some products, like GitHub Copilot, can be actively monetized so users can access it. Others, like the kinds of AI used by internal marketing teams, for instance, will be harder to justify the cost for. Still, investors are betting big on the future of the technology.

Just a Phase?

Notably, the kinds of chips required to make large language models, generative AI, and other programs like them function aren’t exactly versatile. Using such tech to power, say, a gaming laptop would be like using a bulldozer to build a sandcastle. As such, if the AI boom collapses, expect to see share prices for companies that specialize in this hardware, like Nvidia, to nosedive.

AI and Regulation

Heading into a big election with generative AI in play could also prove to be a bit tricky. While excitement around the technology remains high, many people have noted it’s likely that the US government could enact regulations on AI to prevent its use to spread misinformation. Moreover, AI has been accused of stealing artists’ work and collating it to create images based on existing art.

High Costs

Beyond the threat of regulation, AI’s failure to turn a profit so far is beginning to put the technology’s high price tag into sharper focus. After all, operating bespoke hardware that consumes huge amounts of power at a loss isn’t a sustainable business model. When will this begin to reflect in companies’ willingness to fork over billions for Nvidia-made computer chips?

The Big Winners

Microsoft, Amazon, and Google rake in millions of dollars every week, so it’s not like they’re in any danger of going out of business due to investing in AI technology. Still, the clear winner in this market is Nvidia, which has seen its stock price soar over the past three years with a huge uptick in interest around AI.

Read More: Is AI Losing Money? The Facts

How Long Will It Last?

For now, people who invested in computer chip manufacturers in 2021 are extremely pleased with themselves. But people who jumped on this hype train late might be wondering when the right time to cash out will be. Sadly, it’s impossible to tell when the bubble is about to burst—or, indeed, if there will be a burst at all. For now, one thing is clear: Wall Street loves AI today. Will they continue to do so tomorrow?

Read More: Why Computer Chips Are Such a Hot Investment Right Now